Fiscal subject related

General information

There are various taxes in Germany that apply either to legal entities or to economic transactions (like VAT). All taxes are governed by their own legal frameworks.

For businesses, tax rates significantly affect pricing strategies and overall profitability. Taxes due must always be clearly listed on invoices or receipts, this is a legal requirement.

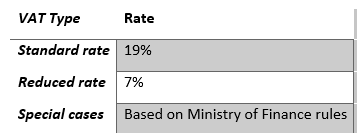

VAT Rates in Germany (As of 2024)

Germany applies different VAT rates depending on the product or service:

The standard 19% rate applies to most goods and services. The reduced 7% rate is reserved for essential items like food, books, and newspapers.

Special VAT rules for the catering industry (As of 2024)

A temporary VAT relief on restaurant food was also introduced but ended on December 31, 2023. As of January 1, 2024, the following VAT rates apply:

- Food consumed on-site: 19%,

- Food sold for takeaway or delivery: 7%,

- Beverages: 19%.

Important exceptions (Beverages):

- Cow’s milk and drinks made mostly with milk (like latte macchiato) are considered staple foods and taxed at 7%, regardless of whether they are consumed in the café or taken to go,

- If the same drink is made with plant-based milk (e.g., oat milk), it is taxed at 19%.

Other news from Germany

New document was uploaded: S4FiscalBackoffice Patch

S4F backoffice patch is intended for users who have already installed S4F backoffice and are intended to update existing installations to latest version. To do so apply only patches that are marked with version number that is newer than your currently installed instance of backoffice. Please make sure to install all available patches sequentially (without skipping). This package contains instruction, release notes, changelog and software packages required for deployment of this software component. Read more

Subscribe to get access to the latest news, documents, webinars and educations.

Already subscriber? Login

Germany Publishes New VAT Return and Prepayment Forms for 2026

Germany

Author: Ivana Picajkić

Germany

Author: Ivana Picajkić

Germany has published new legally binding VAT return and advance-payment forms for 2026, released on 29 December 2025 and mandatory for all VAT filings via ELSTER. Read more

Subscribe to get access to the latest news, documents, webinars and educations.

Already subscriber? Login

Germany Publishes Its Electronic Business Address (GEBA)

Germany

Author: Ivana Picajkić

Germany

Author: Ivana Picajkić

Germany has introduced the German Electronic Business Address (GEBA), published on 18 December 2025 by XStandards Einkauf, as a standardized electronic identifier to accurately route e-documents—especially e-invoices—within networks like Peppol. While GEBA is voluntary, it enhances interoperability, clarity of sender/receiver identification, and readiness for future digital tax and reporting frame... Read more

Germany: Businesses Must Prepare for E-Invoicing Earlier Than Expected

Germany

Author: Ivana Picajkić

Germany

Author: Ivana Picajkić

Although mandatory B2B e-invoicing in Germany will only apply from 2027, businesses have been allowed to use e-invoices voluntarily since January 2025 and adoption is accelerating as 2026 approaches. As more suppliers switch early, companies operating in Germany already need to be technically ready to receive structured e-invoices to avoid compliance and operational disruptions. Although mandatory... Read more

Germany: Court Confirms Tax Authorities Can Request Tax-Relevant Emails During Audits

Germany

Author: Ivana Picajkić

Germany

Author: Ivana Picajkić

German tax authorities are increasingly requesting tax-relevant emails during audits, and a 2025 Federal Fiscal Court ruling confirmed that such emails must be retained and disclosed when they contain relevant commercial or tax information. Read more

Subscribe to get access to the latest news, documents, webinars and educations.

Already subscriber? Login

Germany and France Update their Common E-Invoicing Standard

Germany and France will jointly update their hybrid e-invoice formats ZUGFeRD and Factur-X on 15 January 2026 to align with EN 16931 and support their upcoming B2B e-invoicing mandates. The new version expands technical capabilities, improves interoperability, and ensures full compatibility between both formats as Europe prepares for unified digital reporting under ViDA Germany and France have ann... Read more

Germany Lowers VAT on Food in Restaurants to 7% from 2026

Germany

Author: Ivana Picajkić

Germany

Author: Ivana Picajkić

The German government has approved the Tax Amendment Act 2025. Starting January 1, 2026, the VAT rate for all food served in restaurants will be reduced to 7%. This change will support restaurants, cafés, bakeries, butchers, and catering businesses What changes on January 1, 2026? Food eaten on-site in restaurants will drop from 19% to 7% VAT. This creates a uniform 7% VAT rate for: din... Read more